Straits Times FORUM page (9 Mar 2005)

I read the article on Forum page on 4 Mar Let Medisave pay premiums after 80 by Trevor Reginald. I applaud Trevor Reginald for making the smart move to switch to IncomeShield so as to take advantage of the Life time coverage instead of remaining in MediShield that cover up to 80.

The Life expectancy is getting higher, and if a person has been covered under MediShield for many years, and medical insurance is most important when a person live beyond 80, and yet at the old age, MediShield unable to continue the coverage and the insured no longer can do a switch after 75 to other insurer, that is really sad.

Both my parents already 77, they have only 3 more years under MediShield, after that, the medical cost would be so much that our Medisave will be depleted by medical cost.

Next, the basic fundamental is "We should use our MediSave to pay premium which is low and predictable, and not use our MediSave to pay medical cost which is high and unpredictable", hence, I agreed with Trevor Reginald that the MediSave should be used to pay premium after 80.

Being a retiree at that age and premium is much higher, every drop of cash become very important, and since we have enough savings in the MediSave, why can't we use those monies to pay premium?

If we run out of cash and unable to pay premium, policy lapsed, then the MediSave would deplete faster when it is being used to pay medical bill. Hence, I second the idea to loosen up and let the elderly use their own money in the MediSave to pay premium and hope that the relevant authority would look into allowing MediSave to pay premium after 80 and also allow MediShield to cover a person a life time just as IncomeShield did.

If IncomeShield can do it, why can't MediShield, that's perhaps a reason why MediShield is loosing market and healthy insured to IncomeShield. If MediSave can compete well with Incomeshield, then it would give the healthy insured more incentive to stike to MediShield and not switching to IncomeShield.

Daniel Choy Tuck Leong

Oct 27, 2009

Curbing price hikes

|

Base valuation on national average

|

THE key question on the price escalation of

resale Housing Board flats is why prices are rising so rapidly, especially in

prime locations.

The problem lies in the process by which

valuation chases after cash over valuation (COV).

For example, a three-room flat in a good

location may be valued at $200,000. But if buyers are willing to pay COV of

$50,000, pushing the trans-action price to $250,000, the valuation of the same

flat will spike correspondingly in the next round, and the process is repeated,

leading to the current unhealthy spiral.

Generally, buyers do not care about

valuation because it is beyond their control. They know that 80 per cent of the

loan can be taken based on valuation and are generally prepared to fork out

between $50,000 and $100,000 for a good location.

One way to break the vicious circle of

valuations chasing after COVs and better regulate resale prices is to base a

typical flat's valuation price on the average price for the the whole of

Singapore.

For example, the valuation of a three-room

flat can be based on the average of all three-room flats.

This would make buyers rethink whether they

are willing or able to afford COVs of $100,000 on top of such a stiff

valuation.

Then resale prices would be unlikely to rise

so rapidly.

Daniel Choy

http://www.straitstimes.com/ST%2BForum/Story/STIStory_446886.html

ST Forum page 18-09-2009

http://www.straitstimes.com/ST%2BForum/Story/STIStory_431278.html

|

|

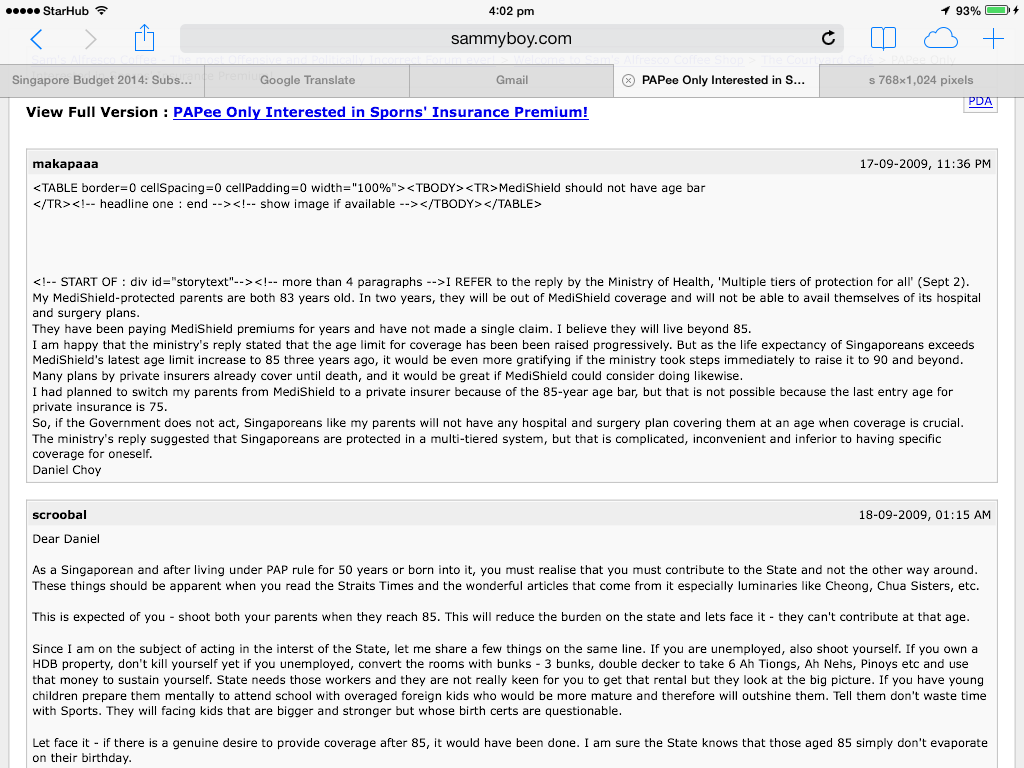

MediShield should not have age bar

|

I REFER to the

reply by the Ministry of Health, 'Multiple tiers of protection for all' (Sept

2).

My

MediShield-protected parents are both 83 years old. In two years, they will be

out of MediShield coverage and will not be able to avail themselves of its

hospital and surgery plans.

They have been

paying MediShield premiums for years and have not made a single claim. I

believe they will live beyond 85.

I am happy that

the ministry's reply stated that the age limit for coverage has been been raised

progressively. But as the life expectancy of Singaporeans exceeds MediShield's

latest age limit increase to 85 three years ago, it would be even more

gratifying if the ministry took steps immediately to raise it to 90 and beyond.

Many plans by

private insurers already cover until death, and it would be great if MediShield

could consider doing likewise.

I had planned to

switch my parents from MediShield to a private insurer because of the 85-year

age bar, but that is not possible because the last entry age for private

insurance is 75.

So, if the

Government does not act, Singaporeans like my parents will not have any

hospital and surgery plan covering them at an age when coverage is crucial.

The ministry's

reply suggested that Singaporeans are protected in a multi-tiered system, but

that is complicated, inconvenient and inferior to having specific coverage for

oneself.

March 6, 2009

MOTOR CLAIMS FRAMEWORK

|

Why no cut in premium?

|

THE Motor Claims

Framework was set up to provide a comprehensive service for all motor insurance

claims. The framework is fully supported by all insurers in Singapore and

allows motorists to make claims in a simple, hassle-free and speedy manner, as

well as bring added benefits of a greater pool of certified motor repair

workshops and related services.

In the past, many

insurers suffered big losses because of inflated third-party claims. Hence the

framework. It has successfully tracked the number of accidents because of

compulsory reporting. But has it successfully reduced the amount of third-party

claims? Can the authorities publish such data?

One benefit of the

framework is that it avoids potentially higher costs from exaggerated claims.

It has been nine

months since the framework was implemented and there is no report on whether it

has been effective in reducing the costs of claims or whether it is working

well. If it is the latter, motor insurance premiums should be reduced. In the

past few months, premiums seem to have risen.

A recent quotation

from NTUC Income indicates that premiums are up again by 19.4 per cent. A

quotation on Feb 27 showed $876.97 and another on Tuesday showed $1,047.15.

So, is the

framework effective in bringing third-party claims down and ultimately, bringing

premiums down?

I READ with

interest the report, 'Poor service is top grouse against real estate agents'.

What we need to

address is the company culture that spreads from the agency boss all the way

down to agents.

To motivate

agencies to take responsibility to produce ethical agents, they should come up

with a set of house rules and emphasise them.

Agencies should be

rewarded if they produce zero complaints or at least the lowest number of

complaints. And agencies that produce the most rogue agents should be

penalised.

http://www.straitstimes.com/ST%2BForum/Online%2BStory/STIStory_446469.html |

||

No comments:

Post a Comment